Sustainability results

We are convinced that engagement is the key to achieving sustainable change. Excluding a company and selling shares simply means giving up the influence you have. This is why we hold companies accountable for their policies and activities. In doing so, we work with other institutional investors where appropriate. With those who are as convinced as we are that active share ownership helps keep companies on their toes, and encourages a greater focus on sustainability.

In the period from 1 January to 31 December 2024, we have:

Sustainable Development Goals (SDGs)

The pension fund subscribes to the 17 Sustainable Development Goals of the United Nations. The engagement activities we undertake with companies can be linked to these SDGs. The pension fund has prioritised four of these SDGs: SDG 5: Gender equality, SDG 7: Affordable & clean energy, SDG 11: Sustainable cities and communities and SDG 13: Climate action.

A large percentage of our engagement activities can be linked to the SDGs. The following shows the number of engagements per SDG over 2024.

We map out the effectiveness of our engagement programme by measuring our progress in milestones. Each path of engagement has four milestones. Once a milestone is reached, we can speak of progress. While, as a pension fund, we believe that engagement contributes to a more sustainable business, actually forging ahead and making progress takes time.

This chart shows how many pathways for each SDG (sustainability goal) have seen progress made, measured over 2024.

Our pension fund actively exercises its shareholder voting rights. We see this responsibility as an opportunity to initiate sustainable change. Every year, we vote at a large number of shareholder meetings. In this process, we take care to ensure that our voting rights are in line with the engagement path we take with companies. Because we believe that this will strengthen the effectiveness of our engagement.

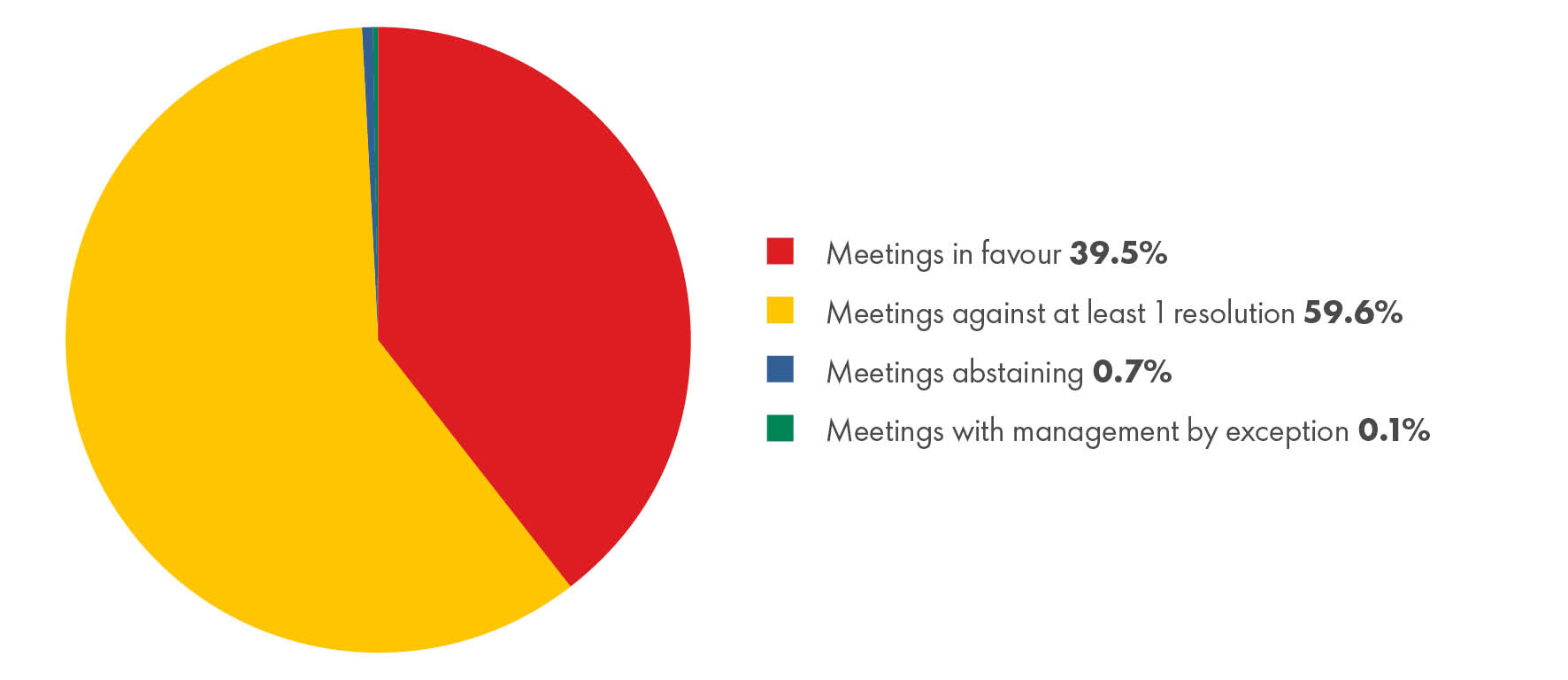

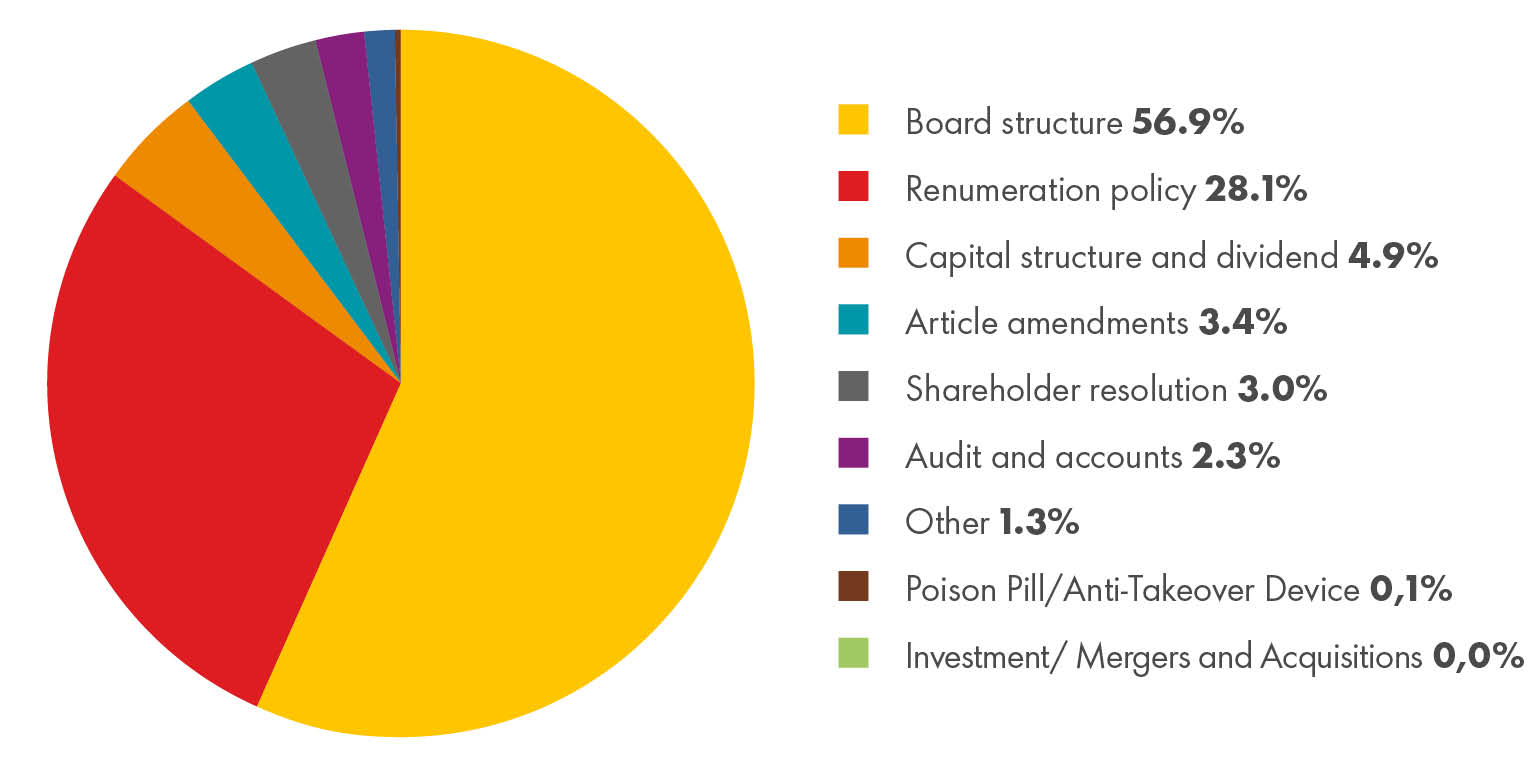

In 2024 we voted on 62,013 resolutions in 5,898 shareholders meetings. In total, we voted against or abstained from voting on 3,802 resolutions.

The issues we voted against are listed in the summary below.

With our ESG policy, we want to bring about sustainable change. We believe that good corporate governance is a prerequisite for improving corporate performance in terms of the environment and society. In line with our climate policy, we also aim to achieve reduced carbon intensity levels with our investments.

We manage our investments against a metric – also known as a benchmark. As a pension fund, we believe it is important for the benchmark to accurately reflect our ESG objectives. For this reason, we use customised benchmarks for the vast majority of our asset classes with these ESG characteristics.

Compared to generic market benchmarks, our own ESG benchmarks show the following improvements:

• A reduction in carbon intensity;

• An improved governance score; and

• At least an equal score with respect to environmental and social factors.