Collective Variable Pension (CVP)

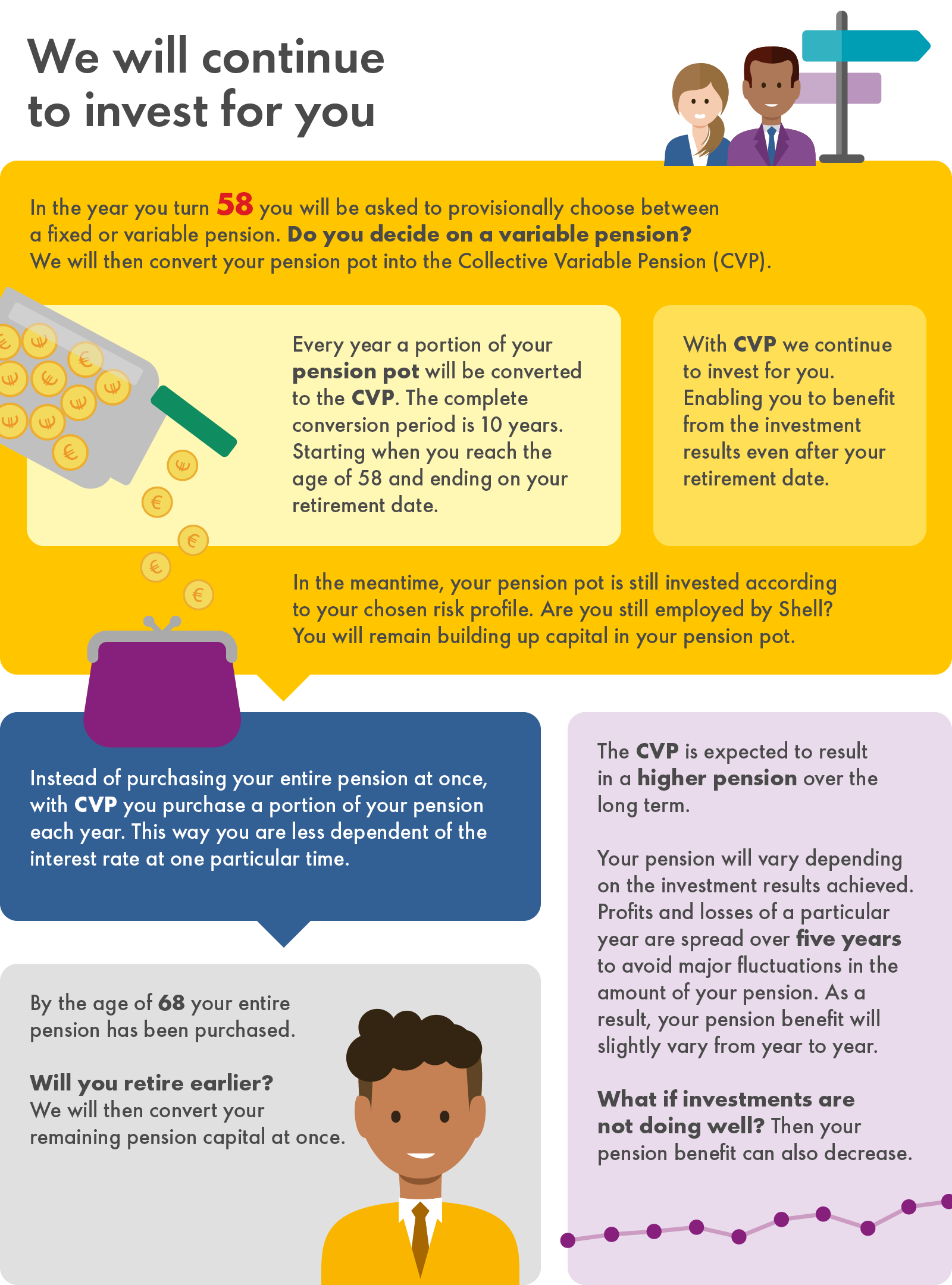

Are you participating in the SNPS pension scheme and/or the Shell Net Pension Scheme? If so, from the age of 58 you can make a preliminary choice for receiving a fixed or variable pension in the future. If you opt for a variable pension, you will start participating in the Collective Variable Pension (CVP) with SNPS. Do you prefer to receive a fixed pension? Then you can take your pension capital to an external pension administrator and purchase a pension benefit from them. On your retirement date, you will make a final choice for a variable or a fixed pension benefit.

In the year you turn 58, we will invite you to make a provisional choice for a fixed or a variable pension benefit. Did you opt for a variable benefit? Then we will gradually convert your pension capital into (variable) pension entitlements in the CVP. Your pension capital is invested in the CVP according to a fixed, collective investment mix. The advantage of this is that you can still benefit from the investment returns made, also after your retirement date. Against this, your pension benefits can also decrease if returns are disappointing. To prevent major fluctuations in the amount of your benefit, the returns made in the CVP are spread over 5 years. In addition, participants share risks of longevity and mortality with each other.

Would you rather receive a fixed pension in the future and do you not opt for the CVP? In that case you will continue accruing pension capital and investing according to your previously chosen Life cycle profile. You will then use your accrued pension capital to purchase a pension benefit from an external pension administrator on your retirement date. The amount of this benefit will then be fixed for the rest of your life.

Watch the video Conversion of capital below to learn more.

On your retirement date you have the opportunity to change the choices you previously made. Are you opting for a fixed pension but would you like to still participate in the CVP? That is possible. In that case, we will convert your pension capital into a variable benefit at once. In that case, you will not use the spread purchase in the CVP. This is why the amount of your pension depends on the interest rate at that time.

You can then also make additional choices in your pension. Are you opting for a fixed benefit? The options will then depend on the pension administrator you have chosen.

The e-learning contains a lot of information to help you choose between a fixed or a variable pension.

Learn more about provisional choices

Read more in the leaflet on the CVP (pdf).

These results are incorporated in your pension benefit with effect from the 1st of July on a yearly basis. Each year you will receive a letter in July about the amount of your pension benefit in the following year. The results - profits and losses - are incorporated in your pension over a period of 5 years. This prevents large fluctuations in your pension, but also means that the level of your pension will vary somewhat from one year to another. It is expected that in time a variable pension is higher than a fixed pension, but there is also a risk that it is lower when returns are low.

Watch the video Spreading of results below to learn more.

| The results of the SNPS gross pension scheme and the SNPS net pension scheme | ||

| Year | SNPS gross pension scheme | SNPS net pension scheme |

| 2023 | 0.515% | 0.93% |

| 2022 | -5.61% | -5.655% |

| 2021 | +5.26% | +5.92% |

| 2020 | +0.96% | +0.32% |

| 2019 | +3.02% | +2.77% |

| 2018 | -2.30% | -2.50% |

Explanation of the 2022 results

Strong inflation and negative sentiment on stock markets

The year 2022 was a special investment year in several ways. Interest rates rose hard due to sharply higher inflation and most asset classes ended the year with sharply negative returns. It was the first time in decades that both shares and government bonds showed negative returns at the same time. The war in Ukraine and the consequent sharp rise in inflation, in part, caused this negative sentiment. In human terms, but also in investment terms, 2022 was a year to quickly forget.

Negative return in 2022 is spread over 5 years

The CVP portfolio invests in a mix of marketable securities, such as shares, and fixed-income investments. Fixed-income investments are mainly intended to keep the pension benefit - which is also sensitive to interest rate changes - somewhat stable. In particular, the marketable securities should over time ensure that pension benefits increase on average. Adding all factors together, including the effect of interest rates on pension benefits, the 2022 effect is that pension benefits would fall by over 5%. However, this result is spread out over 5 years: one-fifth of the negative result thus affects pension benefits for the next 5 years.

Results from previous years are also spread over a five-year period. For instance, the result on pension benefits in 2021 was just over 5% positive. If you also participated in the CVP in 2021, the negative result of 2022 is therefore roughly cancelled out against the positive result for 2021.

Long-term purchasing power

With Shell's innovative pension scheme, we aim to increase your pension on average. In times of a very sharp rise in inflation, such as in 2022, your pension benefit will not move 1-to-1 with inflation. The investments are not designed for that.

Watch the video Spreading of results below to learn more.

You can find the latest details we have for you at my-Shell pension

It is important that you know what you can expect, particularly when your pension amount may vary. The current status of your CVP entitlements is available in my-Shell pension.

It is important that you know what you can expect, particularly when your pension amount may vary. The current status of your CVP entitlements is available in my-Shell pension