Risk profile

You decide

The risk we take when we invest your pension contributions.

We invest for your pension

The pension you will receive later depends on a number of factors, including the results of the investments. Investing also involves a certain risk. More risk can make for a higher pension, but also for a lower one. Your profile determines the risk we take when we invest your capital.

Check your risk profile in my-Shell pension

There you will find some questions about your risk profile. Choose a risk profile step by step that suits you:

- You get explanations

- You fill in your details and answer the questions

- You choose your risk profile

- You see how this will affect your pension

- You can always go back in the process

Your risk profile is medium risk by default. This profile is based on research taken among our participants. Your situation can be different. Do you, for example, have extra income or can you adjust your spendings? Then you might be able to take more risk. If you don’t. Then it might be better to take less risk. The questions in my-Shell pension will help you to decide which profile suits you best. Below you can read about the profiles that are available.

The risk profiles: choose your risk profile: less risk, average risk or more risk.

We invest the capital for your pension that suits your risk profile:

- Taking less risk means more certainty, but there is a smaller chance of a higher capital.

- In the event of more risk: your capital could be higher but it is also less secure.

- In the event of avarage risk, the risks and expected outcome are more balanced. This profile is between less and more.

We used to call the profiles differently: average neutral, less risk defensive and more risk offensive.

You can always change the profile. If you would like to know more about how we invest your contributions, read about our investment policy and responsible investment. If you don't choose a profile, then we will invest on the basis of the average profile. The results of past years are shown at the bottom of this page.

Lifecycle investing: less risk as your retirement gets closer

We take less risk with investments as your retirement date gets closer. We call this lifecycle investing. In addition, in the year you turn 58, you make a provisional choice between a variable pension and a fixed pension. That choice also determines how we will invest for you. On your retirement date you will make a final choice for a fixed or variable pension.

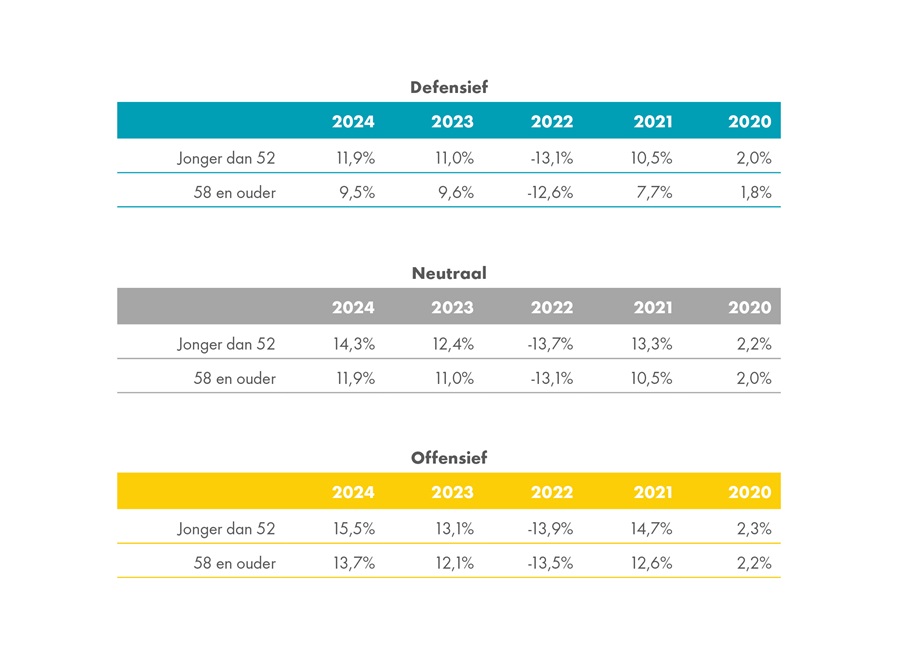

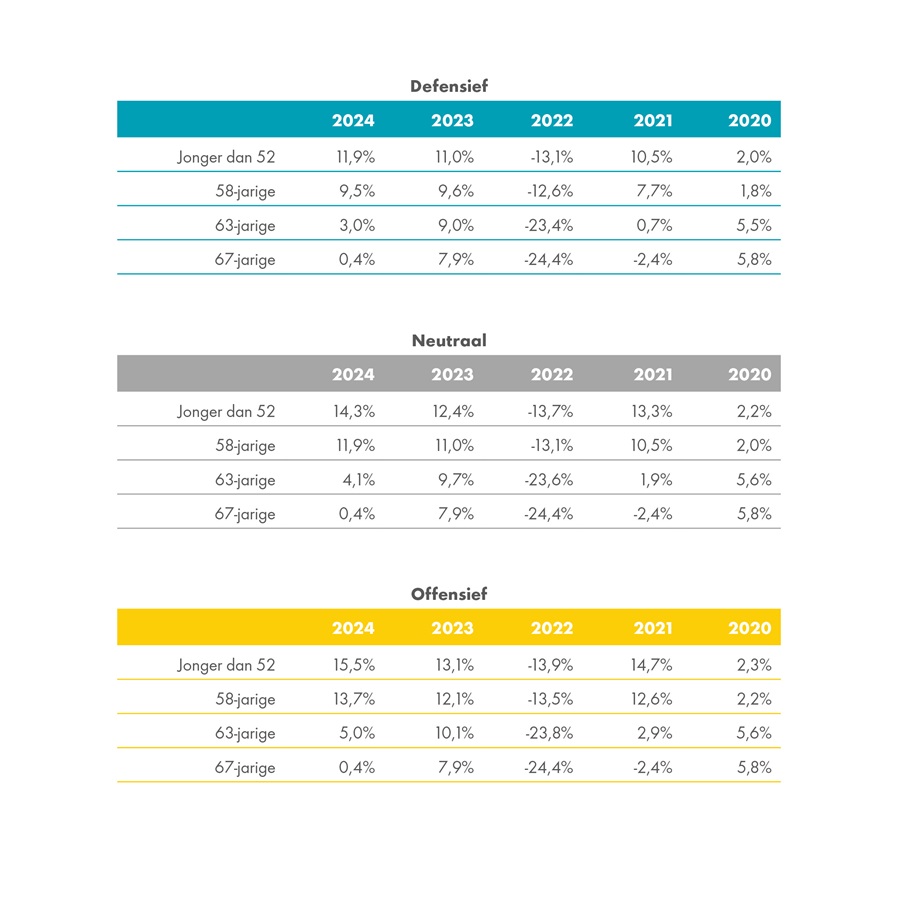

Investment results in the past five years

- the participants who have opted for a variable pension. The results are divided into age groups: under 52 and 58 and over.

- the participants who have opted for a fixed pension. The results are divided into age groups.

Opted for variable benefits

Opted for fixed benefits

Thank you for your feedback!