Frequently asked questions

The new pension scheme

The draft pension scheme has been drawn up by Shell Netherlands and the Central Works Council (COR). To this end, they have had talks with various parties to reach a well-informed and balanced decision, part of this process involved submitting the draft transition plan to the Voeks (the Shell Former Employees Association) ‘right to be Heard’ Committee (VHC). This committee has made its views known to Shell Netherlands and the COR. Shell and the COR have factored that view into their final proposal. If you have any questions about the VHC, you can send an e-mail to Voeks.

Shell Netherlands and the COR have reached their final decision on the new pension scheme in June 2024. Subsequently, they have instructed the boards of SSPF and SNPS to implement the new pension schemes and transition measures. The boards will consider the request of Shell Netherlands and the COR. In doing so, they will weigh up the interests of all participant groups. Part of this process involves asking the opinion of the Accountability Body (AB). Following the opinion of the AB, the pension funds will decide whether to accept the mandate to carry out the new scheme – as laid down by social partners. If so, the pension funds will move to implement the scheme. The supervisory authorities DNB and AFM will need to approve of the way in which SSPF respectively SNPS aim to proceed with the implementation of the transition agreements.

Based on the assignment, the board of SNPS submitted both an implementation plan and a communication plan to the supervisory authorities DNB and AFM, in December 2024.

SSPF will follow over the course off 2025.

In broad terms: the new pension system allows you to accrue your own personal pension capital. You use this capital to purchase a pension benefit when you retire. This gives a much clearer overview of the contributions you pay and the capital you accrue from your contributions. Furthermore, pensions will move more in line with investment results. Pensions will increase sooner in good economic times, but will also fall quicker in times of economic hardship. This will make pensions in the Netherlands more future proof. At Shell it makes a difference whether you are still actively working at Shell or have already retired, and if you accrue pension or receive a pension from SSPF and/or SNPS.

You can learn more about the main pints of the Future of Pensions Act and the possible consequences for you on our website.

The new pension legislation affects not only employees but also retirees and former employees. A key component in the Future of Pensions Act (Wtp) is that accrued pensions will be changed to the new system. The term we use for this is ‘converting’. Those accrued pensions then become part of your personal pension pot. When pensions are converted, any guarantee provided by the employer will lapse. Under the new system, it is no longer necessary to maintain reserves (buffers).

If the accrued pensions are converted, the pension reserves (buffers) held with the pension fund are also released. These buffers can then be distributed. One way of doing this is by adding the buffers to individual pension pots (possibly spread over several years) or by setting them aside to cover certain risks.

Shell Netherlands and the COR have reached their final decision on the new pension scheme in June 2024. This also states whether they want to convert previously accrued pensions to the new scheme. Subsequently ,the boards will consider the request of Shell Netherlands and the COR.. To reach an informed decision, they will weigh up the interests of all participant groups. Part of this process involves asking the opinion of the Accountability Body (AB). Following the opinion of the AB the pension funds will decide whether to accept the mandate to carry out the new scheme – as laid down by social partners. If so, the pension funds will move to implement the scheme. The supervisory authorities DNB and AFM will need to approve the way in which SSPF and SNPS intend to implement the transition agreements.

The SNPS pension scheme already complies with the Wtp (Wet toekomst pensioenen). In principle, the pensions already accrued will remain unchanged and will be transferred one-to-one to the new pension system.

Under the Future of Pensions Act, the government has decided that it is not possible for you as an individual to object to the conversion to the new pension system. Current employees, former employees and retirees are represented in this process by the Central Works Council (COR).

The COR considers the interests of all the different participant groups and the employer as part of the consultation process. In addition, the interests of former employees and retirees are also represented by the Voeks ('Association of Former Shell Employees') committee for the right to be heard ('VHC'). The VHC has shared its views on the draft transition plan in which the proposal for the changes is set out. Shell Netherlands and the COR have factored these views into their deliberations. If you have any questions about the VHC, you can send an e-mail to Voeks.

Shell Netherlands and the COR have reached their final decision on the new pension scheme in June 2024. Subsequently, they submit an assignment request to the boards of SSPF and SNPS. The boards of the pension funds consider the request of the Shell Netherlands and the COR. In doing so, the board will weigh up the interests of all participant groups. Part of this process involves asking the opinion of the Accountability Body (AB). The participation in the pension fund, the VHC and the assessment by the pension fund gives the assurance that the interests of current employees, former employees and retirees are represented. Following the opinion of the AB), the pension funds decide whether to accept the mandate to carry out the new scheme – as laid down by Shell Netherlands and the COR. If so, the pension funds will move to implement the scheme. The supervisory authorities DNB and AFM need to approve the way in which SSPF and SNPS intend to implement the transition agreements.

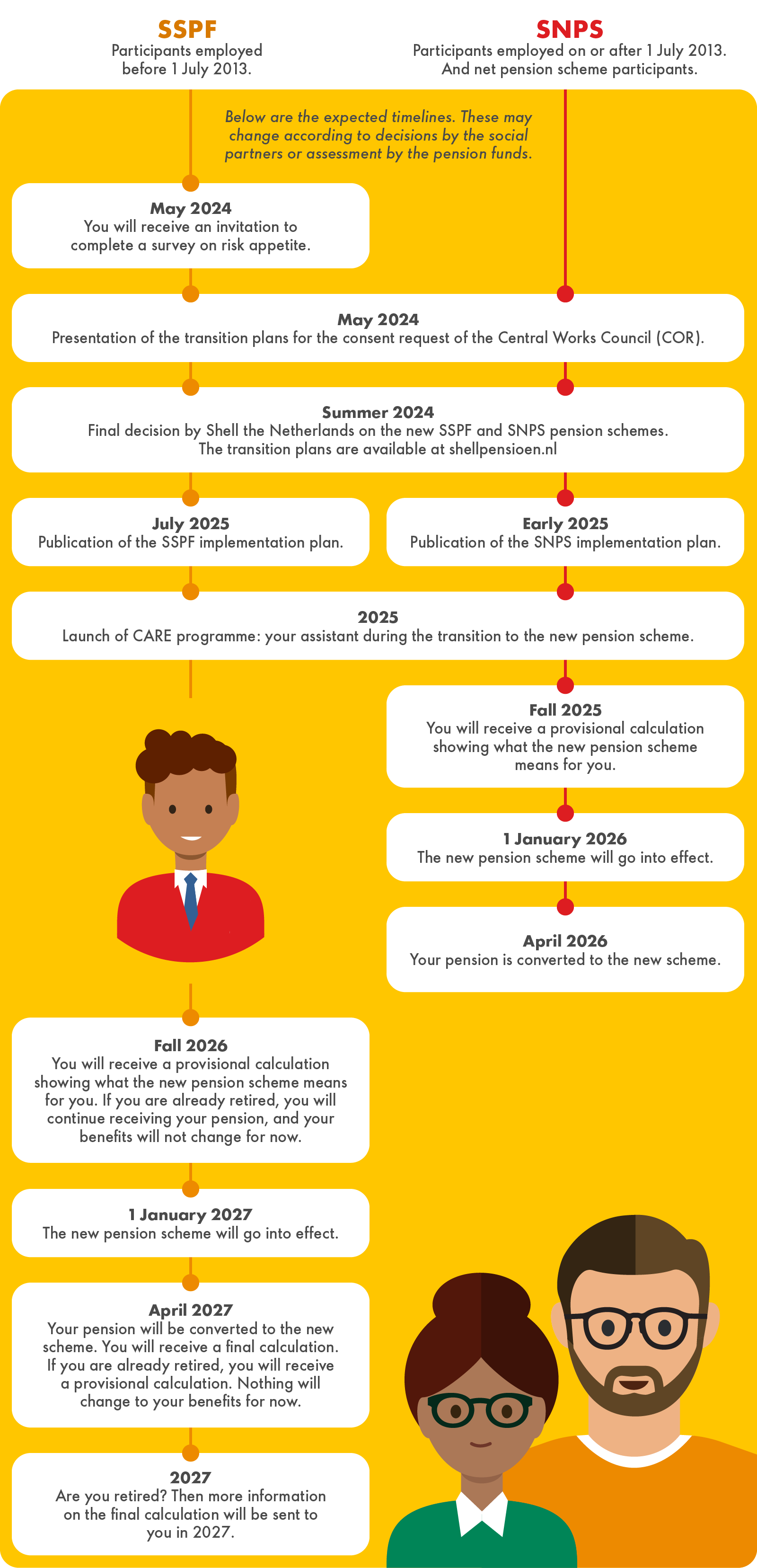

It will be some time before you hear how the changes will affect you personally. Shell Netherlands and the COR have reached their final decision on the new pension scheme in June 2024. Subsequently, they submit an assignment request to the pension funds. In the next phase, the boards of the SSPF and SNPS pension funds will review the request. To reach an informed decision, they will weigh up the interests of all participant groups. Part of this process involves asking the opinion of the Accountability Body (AB). SNPS is expected to transfer to the new pension scheme on 1-1-2026.

Based on the assignment, the board of SNPS submitted both an implementation plan and a communication plan to the supervisory authorities DNB and AFM, in December 2024.

SSPF will follow over the course off 2025 and is expected to transfer to the new pension scheme on 1-1-2027.

The entire process requires the utmost care and thoroughness. We can only calculate what the expected changes will mean for you personally just before the actual conversion to the new scheme.

Read more about this in the interview with Eveline Smeets.

Of course, we want to guide you to the new pension scheme as best we can. That is why Shell Pension has developed a CARE programme that is dedicated to providing you with information in a way that suits you. We will be sure to keep you informed through e-mails, webinars, participant meetings and, if you need, even personal coaching. So make sure we can reach you! Then we can keep you informed. If you have not done so yet, please leave your e-mail address on my Shell Pension and set your preferred communication method to digital.

In June 2024 Shell Netherlands and the Central Works Council (COR) have reached their final decision on the implementation of the new SNPS pension scheme, in accordance to the Future Pension Act (Wtp). Based on this decision they submitted the transition plan to the board of SNPS. This transition plan contains the assignment for implementation of the new pension schemes and transition measures. Subsequently the SNPS board has made an implementation plan, in which is described how to proceed with the implementation of the transition agreements. This implementation plan is submitted for approval to the supervisory authority De Nederlandse Bank (DNB), in December 2024. In addition, a communication plan has been submitted for approval to Autoriteit Financiële Markten (AFM).

SNPS is expected to transfer to the new pension scheme on 1-1-2026.

The implementation plan for SSPF will follow over the course off 2025.

- Keep an eye on the website or visit CARE Shell Pension

- Make sure we can reach you! If you have not done so yet, please leave your e-mail address on my Shell Pension and set your preferred communication method to digital.

• Have you registered your partner? You can check this on my-Shell pension

• Are you thinking about your retirement? Make an appointment for a video call.

Arrange by yourself

Did you join Shell before 1 July 2013 and was the Netherlands your base country before that time? If so, you participate in the pension scheme of SSPF (Stichting Shell Pensioenfonds).

Did you start working for Shell on or after 1 July 2013? Or did you join Shell before 1 July 2013 but only have the Netherlands as your base country after that date? Then you participate in the pension scheme of SNPS (Shell Nederland Pensioenfonds Stichting).

In addition, since 2015 you can accrue pension under the SNPS Net pension scheme if your salary is above the statutory fiscal maximum. That means you have two pension schemes.

Visit the Pension 1-2-3 to read what you are entitled to through our pension scheme.

Want to know how much pension you can expect when you retire? Then log in to my-Shell pension, your personal portal.

You can find all your pension information on my-Shell pension, your personal portal. Here you have a comprehensive overview of your pension situation with Shell. We also explain what happens in case your work or private situation changes, which may also affect your pension. In ’My Archive’ you have access to all your personal documents.

This personal portal is intended only for you. By logging in, we know who you are. It's your digital passport.

Yes, you can! You can fully access your personal portal from your desktop, notebook or tablet. For smartphone access, we have slightly adjusted the screen layout, so the content can also be viewed on a small screen.

We receive information about you from different authorities. Your employer supplies us with your name. Do you live in the Netherlands? Then we get your residential address and marital or registered partnership status from the Basic Registration of Persons (BRP). This is information you can't change yourself.

Are you cohabiting (unmarried)? The details of your (unmarried) partner is not passed on to us automatically. You can provide this to us yourself by means of a notarial deed.

Are you living abroad? Then it's important that you notify us personally of any changes to your address and marital or registered partnership status. You can, however, still change your communication preferences (both language and form) in my-Shell pension, such as your e-mail address, telephone number and correspondence address.

By following a few simple steps, you can pass on your contact information. This way you won't miss out on updates concerning your pension and we can always reach you. Even after you have left Shell or have plans to leave.

If you don't have a DigiD, you can create an account on the DigiD website. The website explains in clear steps what you need to do. Once you have done this, you can log in at my-Shell pension.

If you don't have a DigiD because you don't have the Dutch nationality or you live abroad, for example, you can create an account. That way, you can log in without DigiD.

After filling in your personal details, you will receive an e-mail with a link to set your password. You then need to download the Google Authenticator app on your smartphone to log in. After you have logged in with your username and password, a QR code will appear on your screen. Using your Google Authenticator, take a picture of the QR code. The app then sends you a code, which you enter on the login page.

You are now successfully logged in.

On your personal portal my-Shell pension you also have access to my-Flex planner, which allows you to see what the consequences of your choices are for your pension. You literally have the controls.

An example:

• Retire fully or part-time.

• Change the retirement pension (partially) to a partner's pension.

• Stop working now and retire later.

• How your pension is affected when you leave the company.

You notify us of your final pension choices on my-Pension Application. This can be done from the age of 55 or older.

Please note: in the new pension scheme some of your pension choices will change. Are you considering retirement? Make an appointment for a video call with Shell Pension. Or check your options for personal guidance on CARE Shell Pension

The percentages for choosing a higher or lower pension have been laid down in the regulations. We use the same percentages for my-Flex planner, my-Pension Application and in our letters. The distribution is explained a little differently in the regulations, but the outcome is always the same.

See the calculation example:

| Highest pension | 100 |

| Lowest pension | 75 |

| Difference | 25 |

| Difference expressed in lowest pension percentage | 33,3% (=25/75) |

| But also: lowest pension is 75% of the highest pension | 75% (=75/100) |

The pension scheme of a number of participants consists of components that my-Flex planner can't calculate. When clicking on my-Flex planner, a message will appear on your screen. If this is the case for you, please contact the customer service team for a personal calculation.

You are allowed to retire from the age of 55. You can apply for your pension one year before you retire. But please do this at least 6 months before your planned retirement date.

Do you want to see the effect of your pension choices first? You can calculate it with my-Flex planner on my-Shell pension, your personal portal. Log in easily and safely with your DigiD.

Do you have a pension with SNPS? If you do, you should send us the application form at least 6 months before you want to retire.

Do you have an SSPF pension? Then please submit your pension choices to my-Shell pension at least 6 months before you want to retire on my-Pension Application.

Do you accrue pension with both SSPF and SNPS? If so, you need to inform both pension funds about your wish to retire.

The choice to continue working part time and to retire part time is not available in my-Pension Application. You can, however, calculate what certain choices mean for you in My-Flex planner. Would you like to apply these choices? And do you want to retire part-time? Then please contact us to arrange a personal calculation for your specific circumstances.

For now, my-Pension application is only available for the average salary scheme of SSPF (Stichting Shell Pensioenfonds).

From the age of 55 you can retire. You can inform us of your choice of pension at least 6 months before you retire. Would you like to see the effects of your pension choices first? Calculate the options without any obligations by using my-Flex planner on my-Shell pension, your personal portal. Log in easily and securely with your DigiD. You can find more information about this subject on the page 'options for your pension'.

Digital communication

There may be several reasons why this isn't working.

We regularly perform updates on our website to always provide you with the latest information. Maintenance may therefore be the reason why you temporarily can't log in. We always try to inform everyone well in advance on the Shellpensioen.nl homepage, so as not to cause unnecessary inconvenience.

If you receive an error message, you can delete the cookies. Then go to my-Shell pension and log in without DigiD. This often resolves the issue.

Did you forget your username or password? If you can't remember your login details for my-Shell pension, you can restore them by following just a few easy steps.

Still don't have DigiD? Then you can create an account on the DigiD website. The website explains in clear steps what you need to do. Once you have done this, you can log in on my-Shell pension. If you don't have a DigiD because you aren't a Dutch national or you're living abroad, you can create a new account, follow the procedure at my-Shell pension.

Communicating digitally offers convenience and flexibility. For you it means that all information is always quickly accessible in your personal portal: my-Shell pension. If you opt for digital communication, you will be notified by e-mail or by post if there is a message waiting for you in ‘My archive’ in my-Shell pension.

If you opt for digital communication, you will be notified by e-mail if there is a message waiting for you in ‘My archive’. You can retrieve all your messages in 'My archive'.

Have you chosen not to receive digital communication? Then you will receive all information only by regular post and all communication can still be found in ‘My archive’ in my-Shell pension.

For us it is essential to have your contact details, and preferably we would like to receive your private details via my-Shell pension. This way we are always able to reach you if we need to inform you about your pension. Even when you aren't home or if you have left the company or you're planning to.

Payment

Your pension benefits are paid into your account every month.

See the payment dates of SSPF and SNPS.

You will receive a specification if your benefit changes. The specifications are sent digitally and are stored in my-Shell pension, your personal portal.

Did you choose not to communicate digitally? Then we'll send you information by regular post and all statement specifications can still be found in my-Shell pension.

When you participate in the SSPF scheme, the pension benefit for January is calculated according to the tax rates of the previous year. This is then corrected in February.

• Indexation if you are working and accrue pension

If you accrue pension, your accrued pension will be unconditionally increased by 2.0% per year in 2022, 2023 and 2024. This is called indexation and occurs annually on 1 February and paid in March.

Should Shell Netherlands decide to change the indexation policy for active employees, the employer will inform employees in active employment.

• Indexation if you receive a pension or have left employment

Every year, the pension fund tries to increase your pension in line with the rise in consumer prices. This is called indexation and takes place annually on 1 February. Indexing is possible only if the financial situation of the pension fund allows for it. That's why the increase cannot be guaranteed. The Board will decide each year whether it is possible to index pensions.

On the indexation policy page you can read how your pension has been indexed in recent years

At the end of February, you will receive the annual statement for the previous year in my-Shell pension, your personal portal. You will be notified as soon as your annual statement is ready. You need the annual statement when filling in your income tax return. If you have not opted for digital communication, you will receive the annual statement by post.

Don't we have your email address yet

And would you like to receive our information digitally? Pass it on to us quickly and easily via my-Shell pension.

Future of Pensions Act (Wtp)

These are the main points. In the new pension system you will accrue your own personal pension capital. You will use this to purchase a pension benefit when you retire. This will provide a more transparent view of the contributions you pay in and the capital you accrue with your contributions. In addition, pensions will move more in line with investment results. Pensions will increase more quickly if the economy is good but they will also fall more quickly in times of economic hardship. This will make pensions in the Netherlands more future proof. At Shell it is of significance whether you are still in active service with Shell or already retired, and if you accrue in or receive from SSPF and/or SNPS.

We would like to inform you about the main points of the Future of Pensions Act (Wtp)and its possible consequences on our website. On the website nieuwpensioenbijshell.nl you will find all important information about the Wtp, current developments and possible scenarios for the future.

A key principle under the Future Pensions Act (Wet toekomst pensioenen) is that accrued pensions will be converted to the new system. This is called ‘invaren’ (conversion). Those accrued pensions then become part of your personal pension pot. When pensions are converted, any guarantee provided by the employer will lapse. Under the new system, it is no longer necessary to maintain reserves (buffers).

If the accrued pensions are converted, the pension reserves (buffers) held by the pension fund are also released. These buffers can then be distributed. One way of doing this is by adding the buffers to individual pension pots (possibly spread over several years) or by setting them aside to cover certain risks. The buffers can also be used to compensate for future pension accruals. The exact use of the buffers depends on the transitional measures Shell NL will discuss with the Central Works Council. After an agreement has been reached, the pension fund will be involved and conduct an assessment.

The principle under the Future Pensions Act, as indicated above, is a conversion into individual pension pots. The Future Pensions Act provides an option to deviate from this principle. This is possible if converting is disproportionately unfavourable to all or some of the stakeholders. Stakeholders include current employees, retirees, former colleagues and the employer. If the exception is used, the accrued pensions will remain in the existing pension scheme. The employer’s guarantee and annual indexation will also continue to apply in that case.

The new pension legislation affects not only employees but also retirees and former employees. This is unusual; normally legal changes only apply to the future, but the new pension legislation under the Future Pensions Act also affects the pensions of non-active participants. The legislature has stipulated this. It is not allowed to distinguish between different types of participants. So if a conversion to individual pension pots will take place, pensions of retirees and former employees will be converted as well. But if the exception (hard closing of the fund) can be used, then the same applies to retirees and former participants. The interests of these two groups also have to be considered by Shell NL and the Central Works Council during the consultation process.

Shell NL and the Central Works Council are also speaking with VOEKS, the association of former Shell employees. VOEKS has a statutory right to be heard about the changes. Ultimately, a balanced decision must be made for all stakeholders, including the employer.

As the pension scheme is a matter between social partners (Shell NL and the Central Works Council), retirees and former employees normally have no formal role in that process. However, the Future Pensions Act has created several safeguards to ensure that the interests of retirees and former employees are taken into account in a timely manner. The transition will have to be balanced for all parties.

How is this implemented? A right to be heard has been introduced. The Future Pensions Act allows a representative association of retirees and/or former employees to make its views known to Shell NL and the Central Works Council before any decisions on the new scheme are made. Shell and the Central Works Council should then factor those views into their decision-making and also provide feedback on how those views were factored into.

At Shell, VOEKS (the association of former Shell employees) is one such representative association. VOEKS has since set up a ‘right to be heard’ committee, which is in talks with Shell NL and the Central Works Council. Former employees can let VOEKS know what they think is important about the new scheme. After all, the interests of retirees and former employees also play a role in the pension funds’ decision-making process. The Future Pensions Act has further tightened this. For instance, if a request for conversions is made, the fund must explicitly consider whether it does not put groups of participants at an unbalanced disadvantage. This also includes retirees and former employees.

In addition, the pension fund’s accountability body has a right to be consulted on the board’s decision. More information about the accountability body of SSPF and of SNPS can be found here. The accountability body also includes members representing retirees and former employees. Finally, De Nederlandsche Bank (DNB) also plays a role. If a request for conversion is made, DNB will also assess whether the pension fund has balanced the interests of all parties involved. This is a marginal assessment, which mainly focuses on the process.

With the transition to the new pension under the Future Pensions Act, it is not possible for individuals to object to the transition to the new pension. Current employees, former employees and retirees are represented in this process by the Central Works Council (CWC).

The CWC should consider the interests of all the different groups of participants and the employer during the consultation process. Moreover, the interests of former employees and retirees are represented by the ‘right to be heard’ committee. The ‘right to be heard’ committee may give its views on the transition plan setting out the proposal for the changes. The employer and the CWC will then have to factor this into their deliberations. In the end, it is all about a balanced decision being made.

Once the CWC has agreed and a formal decision has been made, the pension fund must assess whether it can implement the new scheme and the transitional measures. In doing so, the pension fund has a legal duty to balance the interests of all parties involved.

In addition, the accountability body of the pension fund has a right to be consulted on the decision of the pension fund’s board and, for SSPF, the Board of Supervisors has a right of approval regarding the conversion decision. Through participation, the ‘right to be heard’ committee and the pension fund’s assessment, it is ensured that the interests of current employees, former employees and retirees are represented.

Investment strategy SSPF and SNPS

No. The SNPS and SSPF schemes are too different to compare.

SSPF is an average pay plan. The amount of the benefit here is fixed. You know in advance how high your pension benefit will be. You accrue an equal part of your pension every year. The pension fund invests the contributions collectively. If the SSPF's financial situation is good enough, the board may decide to index the pensions. Your pension will then be increased.

SNPS is a defined contribution scheme. The contribution here is fixed. That contribution goes into your pension pot, and this pension pot will then be invested. You can decide how much risk is involved with these investments. The investment results go into your pension pot as well. With the capital in your pension pot you buy a benefit when you retire. The scheme aims to ensure a good pension for all participants, but you do not know exactly how high your pension will be in advance. If you opt for a variable pension, you will then continue to invest with SNPS after retiring. As a result, the investment results can increase your pension. In the case of negative investment results, your pension could also be lower. With SNPS, we spread out the returns over a five year period. That means the impact of any annual outliers is reduced.