Financial situation

The Pension Fund must ensure that the pension undertakings given by the employer can be paid both now and in the future. This is why we use the funding ratio.

What is the funding ratio?

The funding ratio indicates the ratio between the obligations entered into by the fund (the payments that the fund must make now and in the future) and the assets that match these. The funding ratio is a snapshot: it shows the financial situation at one particular moment in time. Hence, it shows whether the pension fund - at the measuring moment - has sufficient resources to pay out all pensions accrued to date, now and in the future.

What is the policy funding ratio?

The policy funding ratio is the average funding ratio over the past 12 months. For policy decisions, such as granting indexation, the Pension Fund looks at the policy funding ratio. In this way, policy decisions are less dependent on 1 measuring moment.

Current funding ratio

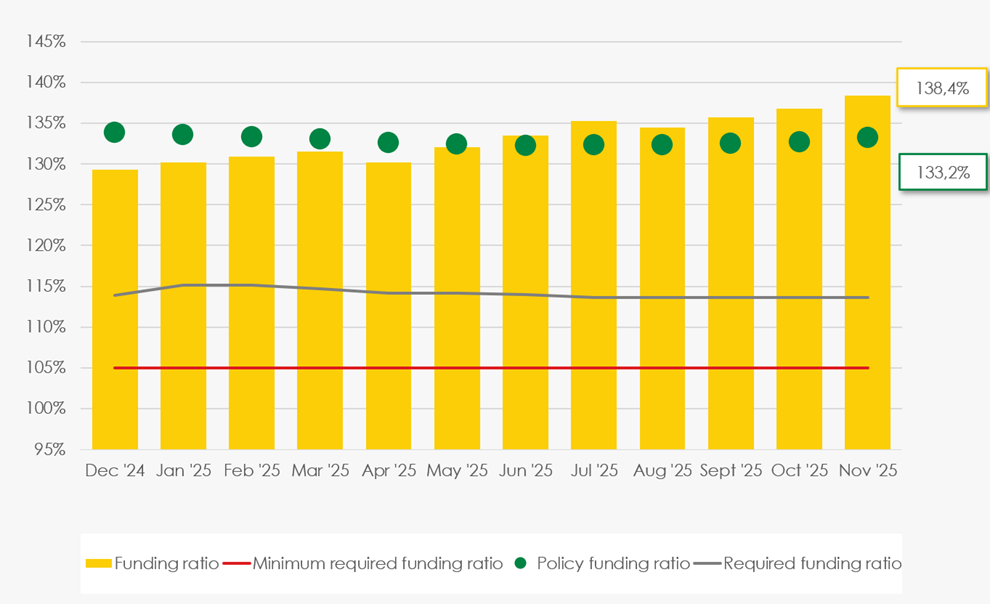

As of 30 November, the funding ratio of Stichting Shell Pensioenfonds (SSPF) amounts to 138.4%, resulting in a policy funding ratio of 133.2%. The graph shows the development of both ratios over the past year.

Explanation of the graph

In addition to the funding ratio and the policy finding ratio, the graph also shows the following figures.

-

Minimum required funding ratio

Pension funds must maintain buffers for the risks they run. The minimum buffer is 5%. If the policy funding ratio falls below the minimum required funding ratio of 105% (red line), there is a funding shortfall. -

Required funding ratio

A pension fund must also maintain a buffer for investment risks (green line). If the policy funding ratio falls below the required funding ratio, there is a reserve shortfall.

If the buffer requirements are not met, the Pension Fund will have to submit a recovery plan to the supervisor (DNB). In this plan, the fund must demonstrate that it will have sufficient buffers again within a defined period of time.