SNPS participants benefit from recovery in share markets

At SNPS, you and your employer both contribute to your pension

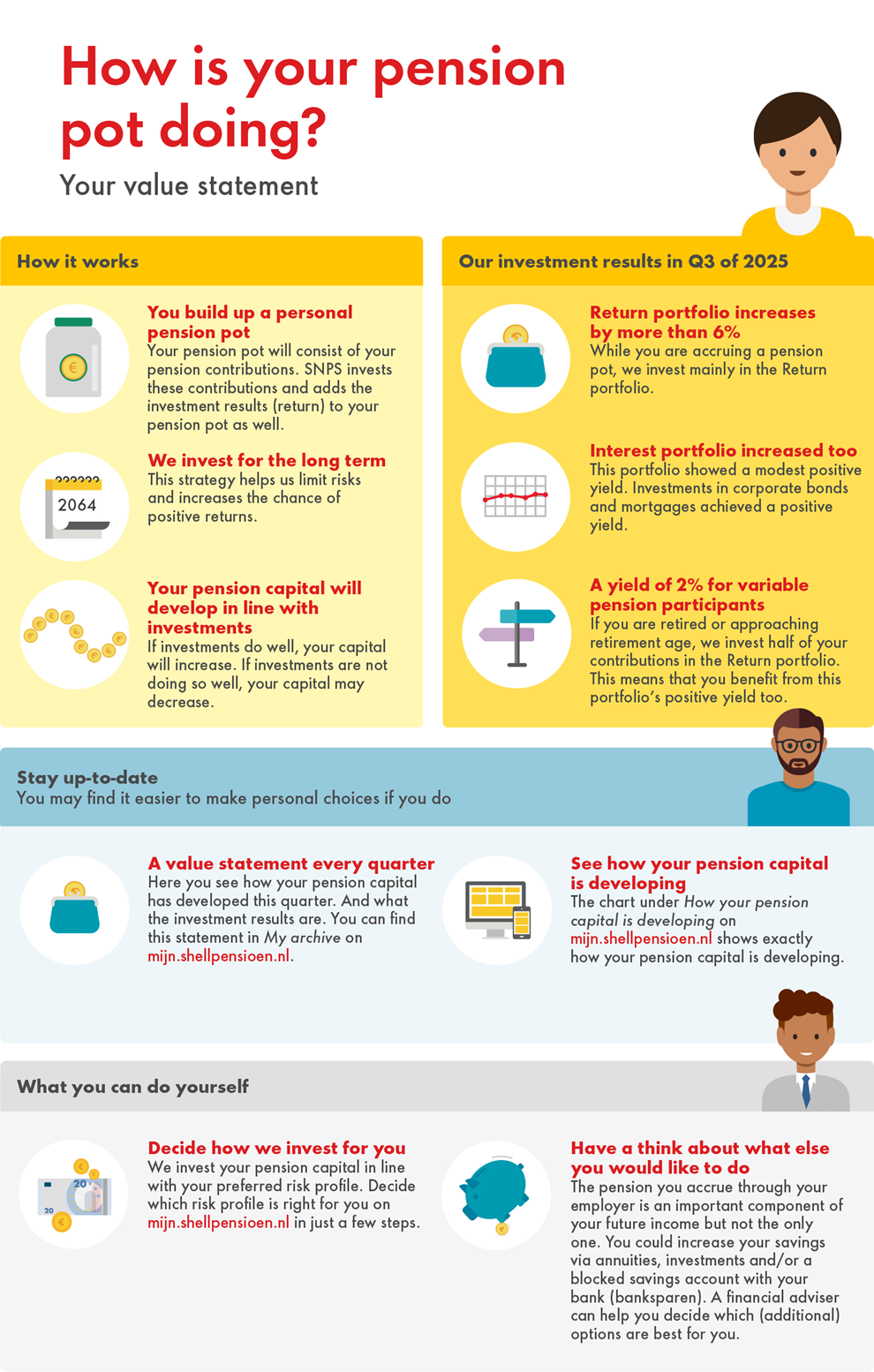

Contributions are paid into your personal pension pot and invested for you. So, your pension pot could grow. There’s also a chance your pension could decrease in value.

Wondering how your pension is performing?

Take a look at your new value statement in the ‘My archive’ section on my-Shell pension.

Check how your pension pot is doing

Text continues below the infographic. There you can read an interview with Jeroen Roskam from Achmea Investment Management. In the interview, he talks about the third quarter of 2025.

Geopolitics continue to dominate news

"America continued to dominate world news in the third quarter of 2025. Trade and budget tensions worsened. Congress approved President Trump's budget, which will increase the deficit substantially in the years ahead. New trade agreements were made with Europe too. Import duties are a little lower than expected but still higher than they were at the beginning of the year. Meanwhile, the United States’ labour market is cooling and unemployment is rising slightly. In France, political unrest resulted in some brief nervousness on the financial markets. In Europe, inflation seems under control, but growth is still lagging."

Central banks reduce interest rates

"Both the European Central Bank and the US Federal Reserve (Fed) kept interest rates unchanged at the beginning of the quarter. However, political pressure to reduce them grew in the United States over the summer. Eventually, the Fed decided to cut interest rates by 0.25 percentage points in September. Its aim is to try to support the economy and employment and also limit inflation. Interest rates in the United Kingdom decreased slightly (to 4%) too. Inflation remains a global concern."

Share markets up due to US interest rate cut

"There has been a positive trend in financial markets in recent months. Shares in particular did really well. Prices rose sharply on strong corporate results and the expected interest rate cut in the United States. The long-term government-bond interest rates rose at the same time. Surprisingly, gold prices rose too, despite confidence in the financial markets. Many investors still see gold as a safe haven investment given geopolitical tensions and uncertainty about inflation and interest rates. Central banks have also bought additional gold in recent months, further driving up the price."

In short, there was considerable movement in the financial markets in the third quarter of 2025. It should be noted that our investment policy is geared towards the long term and our investment portfolios have a good spread.

Your pension pot after the third quarter of 2025

How has your pension pot been affected by the investment results and by political and economic developments? "To summarise: your pension pot has continued to grow steadily in the last three months."

Return portfolio increases by more than 6%

"The share markets performed very well and the other risk assets achieved (modest) positive yields as well. While you are accruing a pension pot, we invest mainly in the Return portfolio. Depending on the risk profile - which you can choose yourself – investments are made in the Interest portfolio too. Investments of a more defensive nature are made via this portfolio. They include investments in European government bonds, corporate bonds and Dutch mortgages. This portfolio achieved a modestly positive yield."

A yield of 2% for variable pension participants

"Have you retired and did you opt for a variable pension? In this scenario, we invest your pension capital in the Collective Variable Pension (CVP) portfolio. About 50% of the CVP portfolio is in the Return portfolio, which performed well this quarter. So, you will benefit from these great results. The other half of the CVP portfolio consists of interest-rate investments. They ensure that pension benefits remain fairly stable. Together, these investments resulted in a positive yield of more than 2%."

If your preliminary choice was for a variable pension and you are now nearing retirement, we will gradually invest more of your pension pot in the CVP portfolio.

Participants whose preliminary choice was for a fixed pension and are now nearing retirement will have part of their pension capital invested in the Matching portfolio. This portfolio achieved a negative yield of nearly 3% this quarter.

The actual pension you receive depends on how much pension capital you have accrued and the interest rate

A higher pension capital doesn’t necessarily mean that the pension benefit you receive will be higher as well. The opposite applies too: a lower capital does not always result in a lower pension benefit. This is because the interest rate also determines how much pension benefit you can buy with your pension capital. If interest rates fall, you will be able to buy a lower pension benefit with the same capital and vice versa.