Financial markets fairly quiet in first quarter

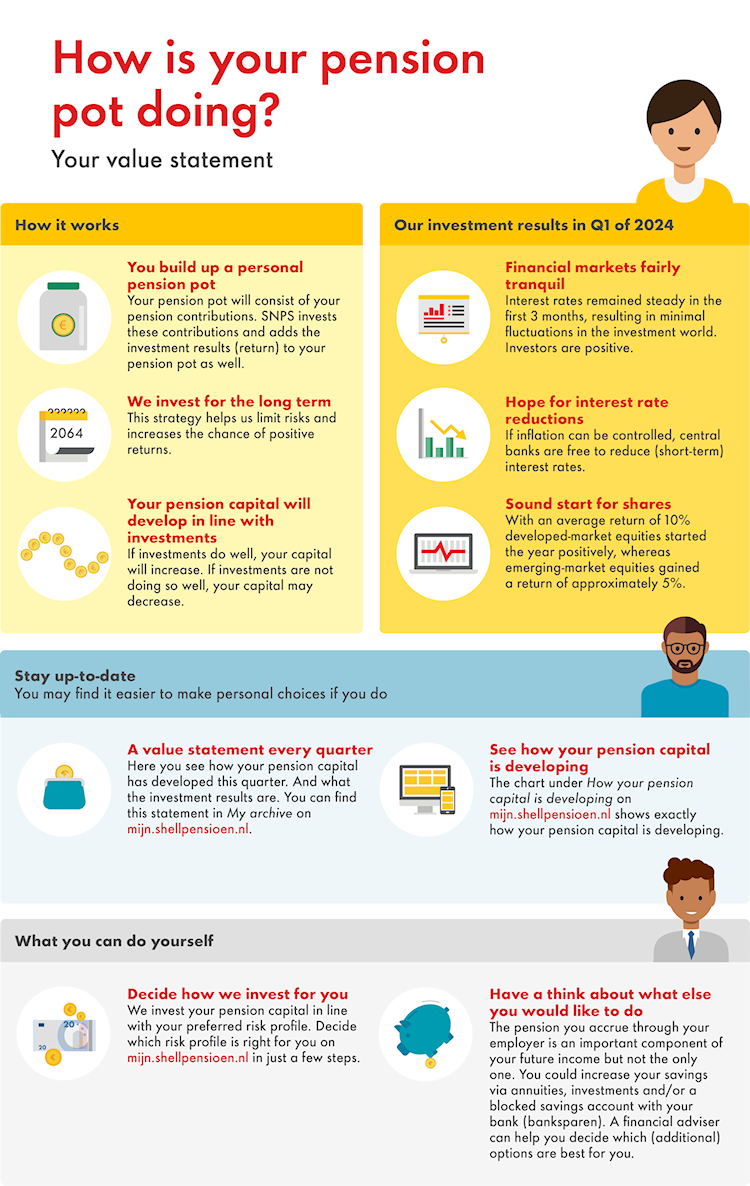

Your pension contributions are used to build up a personal pension pot with SNPS. SNPS invests this pension pot to ensure that you will have a good pension in the future based on the investment earnings (yield). That doesn’t come without risk. Investments can yield more, but it is also possible to lose money.

Want to know how the last quarter has been for your pension? You can find out through your value statement on my-Shell pension under My archive.

Also read the interview with Jeroen Roskam, Fiduciary Advisor at Achmea Investment Management (AIM). He updates us based on 7 keywords in the article under the infographic.

Find out how your pension pot is doing

Rest - interest rates are stable

“It is pretty quiet in the world of investments at the moment. This is because interest rates have been quite stable for the first 3 months of this year. That was different last year, when interest rates shot up only to go down sharply again. Investors are clearly feeling comfortable and positive at the moment.”

Geopolitical turmoil - but markets relatively calm for now

“Of course a lot is happening on the geopolitical front. China in particular is keeping minds busy in the world of investments. But all this turmoil - be it the war in Ukraine or Gaza - is no surprise to investors. Stock market prices have already adjusted accordingly. Unless something unexpectedly drastic happens, which of course is always possible. For now, the markets remain quite calm.”

Interest rate cut - short-term interest rates likely to fall in June

“Short-term interest rates will probably go down around June. This is the interest rate set by central banks and used for short-term loans/credits. If the economy grows faster than expected, inflation may rise again. In that case, central banks will not be quick to cut (short-term) interest rates. But as long as inflation remains under control, the way seems clear for interest rate cuts. Incidentally, this does not mean that long-term interest rates, or capital market interest rates, will also fall. Examples are government bond and mortgage interest rates. This is because they depend on supply and demand and market expectations.”

Equity markets - 10% average return on developed markets equities

“The global economy, and especially the American economy, is performing quite well at the moment and we see that reflected in equity markets. Last quarter, developed markets equities showed an average return of around 10%. American AI technology companies in particular are doing very well. Their value has skyrocketed recently. For example, the AI company Nvidia recently rose over $ 200 billion in value in 1 day on the stock exchange.”

Emerging markets - performance lags behind that of developed markets

“Where developed markets are currently performing well, we see emerging markets - of which China is a major part - lagging. These equity markets achieved an average return of 4%. The Chinese magic formula of initiating many construction projects to boost economic growth seems to have lost its power. However, SNPS investments did outperform that 4% with a 7% return. SNPS also previously decided to slightly reduce investments in emerging market equities and invest a larger proportion of the portfolio in developed market equities. In hindsight, that was a good decision.”

ESG - fewer CO2 emissions in portfolio

“In these months, too, we take into account our ESG objective when choosing investments. Briefly, it boils down to the fact that within the developed markets equity asset class, we emit on average 15% less CO2 than the well-known ‘MSCI World Index’. So our portfolio emits less CO2 than the world index. We also attach importance to good governance of the companies we invest in. That is also an important factor when it comes to the composition of the equity portfolio.”

To keep an eye on - high valuation of shares realistic or too optimistic?

“Investors now seem quite optimistic about the future. This is reflected, among other things, in the rather high valuations of shares. That may be justified, but it could also be that investors are over-optimising the economic future. The expectation now is that the western economy will remain strong, inflation will remain under control and short-term interest rates could fall again. But as always: the moment positivism reigns supreme, there is also more room for setbacks.”