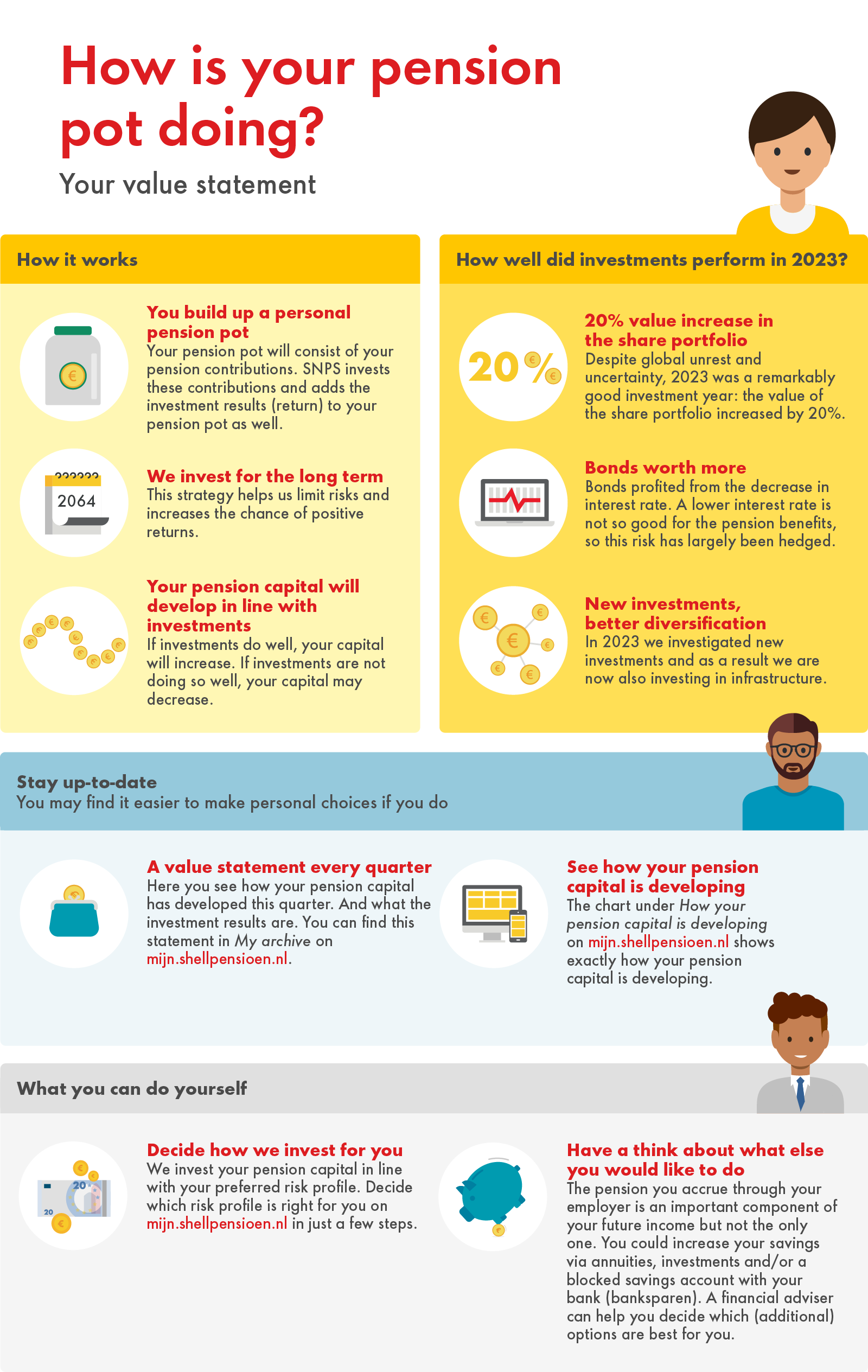

"A turbulent year, but good results"

Your pension contributions are used to build up a personal pension pot with SNPS. SNPS invests this pension pot to ensure that you will have a good pension in the future based on the investment earnings (yield). That doesn’t come without risk. Investments can yield more, but it is also possible to lose money. Want to know how the last quarter has been for your pension? You can find out through your value statement on my-Shell pension under Archive. Also read the interview with Jeroen Roskam, Fiduciary Advisor at Achmea Investment Management (AIM). He meticulously explains what to look out for in the article under the infographic.

REMARKABLE: 20% gain in equity portfolio

“It is remarkable just how good this investment year has been, with another rally in the fourth quarter. Remarkable in that there is still a great deal of unrest and uncertainty: the wars in Ukraine and the Middle East, a banking crisis in Switzerland, not to mention high inflation. In fact, you might imagine that our investments had a tough year. But nothing could be further from the truth. The equity portfolio showed a gain of more than 20%.”

PEAKS AND VALLEYS: bonds and shares rose in value (with a low interest rate)

“I immediately think of interest rates and inflation. Last year, inflation dropped sharply while interest rates initially continued to rise. But as the drop in inflation was continuing, interest rates went down dramatically. This is favourable because it means that bonds and shares are worth more. But low interest rates are unfavourable because participants are able to purchase less pension. Fortunately, SNPS has largely hedged interest rate fluctuations. The impact on participants is limited.”

KEEPING A CLOSE EYE: major economic challenges

“Some scientists and economists are predicting that developments in AI (artificial intelligence) will bring about economic growth similar to the advent of the internet. And more than half of the world’s population will be going to the polls in 2024. This is a unique situation. It could affect factors such as the global economy if a large number of countries embrace nationalism or, conversely, globalisation and cooperation. Finally, the question remains as to whether inflation will continue to fall or if it will end up increasing again. We are facing major economic challenges and the impact is impossible to predict. Another reason for us to keep a close eye on it.”

WORLDWIDE INVESTMENTS = spreading the risk

“For SNPS, we invest globally in a variety of asset classes. For instance, we invest in government bonds in emerging markets such as China, India and Brazil, and we also hold shares in hundreds of companies worldwide. We do this in order to spread the risk as much as possible. When things are a bit less favourable in one country, they often fare better in another.”

POSITIVE ENERGY: Our ESG goals guide our investment portfolio

“When composing our investment portfolio, we make conscious choices in terms of ESG (Environmental, Social and Governance). With the help of a specialised company, we put these decisions into practice by investing in a category of ‘equities’ based on our ESG goals. There are two decisive factors here: sustainability and long-term yield.”

READER QUESTION: Should you invest more cautiously once you retire?

“Our participants want to know what has been happening in the portfolio over the past year. To start with, we have added an asset class: infrastructure. In other words, we are now also investing in toll roads, airports, pipelines and similar areas. Investments in infrastructure provide additional portfolio diversification. Infrastructure will play an important role in the climate transition. We have also improved our pension scheme in a way that allows us to continue investing in diversified asset classes at the stage when you are receiving a pension/variable pension as much as when you are accruing a young pension.”

RISKS: less risk and more profit through smart diversification

“Investing is all about dealing with uncertainty. And there is always uncertainty. One way or the other: we spread investments to the greatest degree possible. This makes our fund robust and resilient enough to cope with a range of setbacks.”